FinTech companies in 2025 face growing pressure to deliver fast, secure, and compliant services. Customer expectations for real-time transactions are rising, and stricter regulations demand higher operational standards.

In this context, DevOps budgeting is a critical part of planning for growth, agility, and compliance. The DevOps budgeting planning in 2025 continues to rise, but so do the stakes for Fintech companies.

On average, the DevOps implementation costs for mid-sized FinTech firms can fall between $150,000 and $300,000 annually, based on typical industry spending across cloud infrastructure, CI/CD pipelines, automated testing, and security layers.

So, where is that money going?

A large portion is spent on cloud infrastructure, CI/CD pipeline tools, automated testing, and security layers, all sensitive to meeting Fintech’s high-speed delivery and strict compliance demands.

So, these investments ensure products can handle sensitive user data, process real-time transactions, and pass regulatory audits without delays.

This guide explains the cost of DevOps for FinTech in 2025 by breaking it down into three key areas: CI/CD pipelines, cloud infrastructure, and security, while providing a clear overview of how each impacts the overall budget.

You will gain insights into typical budget ranges, key factors influencing expenses, and practical strategies to develop a scalable DevOps approach that balances operational efficiency with financial sustainability.

Table of Contents

Before we get into the numbers, let’s zoom in on the role DevOps plays in shaping how FinTech builds, tests, and secures its products.

What Does “DevOps” Mean in Fintech?

DevOps in Fintech refers to the structured integration of development and operations teams to improve software delivery speed, system stability, and regulatory readiness. Instead of operating in isolated silos, teams collaborate across the product lifecycle.

This shift enables financial platforms to respond more quickly to market needs and minimize costly downtime.

For example, a mid-sized digital payments startup adopted DevOps to handle rapid growth. By integrating automated CI/CD pipelines and cloud-native infrastructure, the team reduced downtime by 40% and passed regulatory audits faster, ensuring both reliability and compliance.

In Fintech, DevOps often revolves around these core areas:

1. CI/CD (Continuous Integration and Continuous Deployment): Enables faster, automated software releases with fewer manual interventions. This helps maintain rapid delivery without sacrificing quality.

2. Cloud-native setup: Supports scalable, containerized infrastructure that adapts to traffic spikes and regulatory requirements. It also simplifies disaster recovery and version control.

3. DevSecOps (Development + Security + Operations): Integrates security at every phase of development, rather than treating it as a final step. This is crucial for compliance-heavy industries like Fintech.

In contrast, traditional IT setups often rely on manual processes, slower release cycles, and separate teams for development, QA, and infrastructure. This separation leads to delays, inconsistent environments, and fragile deployments, none of which fit the pace or compliance needs of modern Fintech.

Furthermore, adopting DevOps helps financial firms maintain tighter control over how code changes affect production environments. For example, automated CI/CD ensures that every code push is tested, verified, and deployed with audit trails intact, reducing risk during critical updates.

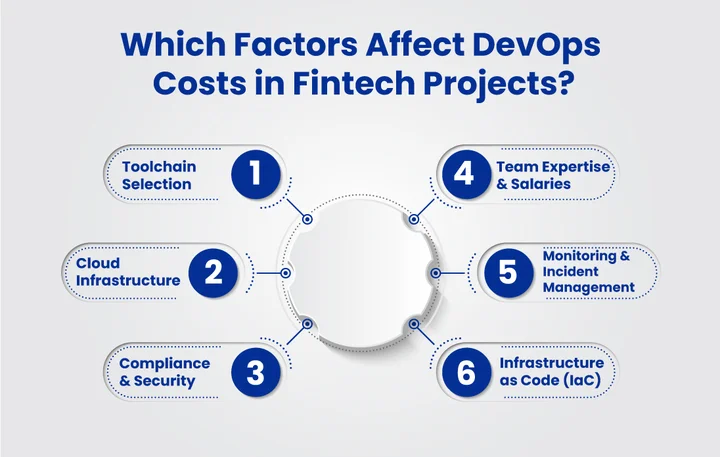

What Drives DevOps Costs in Fintech Projects?

DevOps is not a plug-and-play model, especially in Fintech, where performance, data integrity, and compliance carry direct financial consequences. The Fintech DevOps project cost depends on how deeply your team integrates DevOps into its architecture, delivery cycles, and security posture.

Additionally, costs aren’t limited to purchasing tools. Ongoing expenses often stem from scaling infrastructure, hiring skilled engineers, and ensuring your systems remain secure and audit-ready.

Without clear visibility into these areas, budgets can spiral quickly, especially when compliance missteps require retroactive fixes.

These expenses can be understood through the following factors:

1. Toolchain Selection

The type and number of DevOps tools used for CI/CD, container management, monitoring, and incident response can greatly affect overall expenses. Specifically, the CI/CD cost for Fintech teams varies based on the chosen tools, with paid enterprise solutions often ranging from $1,000 to $5,000 per month, depending on features and usage.

2. Cloud Infrastructure

DevOps pricing for financial services is influenced by the size of your compute, storage, and backup requirements, and which of you use AWS, Azure, or GCP. A Fintech product with thousands of users could easily see cloud costs exceed $100,000 annually, especially with redundant architectures and regulatory-grade uptime.

3. Compliance and Security

Built-in encryption, key management, audit logs, and automated compliance checks come at a premium. Budgeting $20,000 to $80,000 per year for security layers is not uncommon for teams operating in regulated environments.

4. Automation Depth

Teams with high automation in CI/CD pipelines typically invest more upfront in scripting, testing suites, and integrations. But reduce long-term manual overhead. Test automation alone can cost $15,000 to $40,000 in initial setup.

5. Team Expertise and Salaries

Hiring DevOps engineers, cloud architects, and security analysts requires budget planning. According to Glassdoor, DevOps engineers in Fintech earn an average of approximately $130,000 per year in the U.S., with cloud specialists commanding even higher salaries.

6. Monitoring and Incident Management

Real-time logging, alerting, and performance tracking tools like Datadog, Prometheus, or PagerDuty add recurring subscription fees, often based on data volume and usage.

7. Infrastructure as Code (IaC)

While IaC increases consistency and lowers long-term operational risks, the initial configuration and training can demand both time and budget, especially when integrating with multicloud setups.

Are You Concerned About Rising DevOps Expenses? We help you optimize your Fintech DevOps costs with expert guidance.

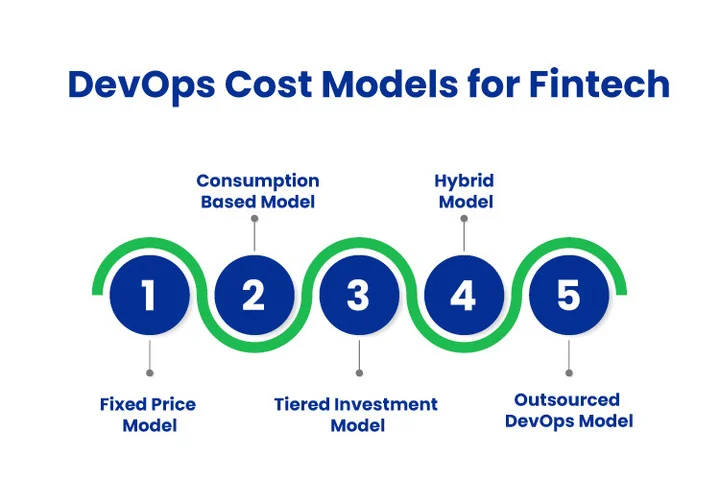

Which DevOps Cost Models Should Fintech Teams Consider in 2025?

Your Fintech product’s ability to scale, adjust to regulatory requirements, and manage infrastructure costs can all be greatly impacted by your choice of DevOps cost model.

Teams that fail to align their cost strategy with delivery goals often end up either overinvesting in tools they don’t fully use or underbudgeting for critical automation and security components.

Furthermore, the cost model you choose needs to reflect your product stage. A team launching an MVP doesn’t require the same setup as a platform handling thousands of daily transactions. Fixed pricing might suit stable environments, but fast-growing teams may benefit from a pay-as-you-grow structure.

To help you choose wisely, we’re now breaking down popular DevOps cost models in Fintech along with their average budget ranges:

1. Fixed Price Model

This model assigns a predictable monthly or annual budget to cover all DevOps-related needs like tooling, infrastructure, support, and personnel. It’s typically used by companies with consistent delivery cycles and established cloud systems. This helps finance teams plan without frequent adjustments.

On average, a small Fintech team following this model spends between $8,000 and $15,000 per month, while a midsized company may allocate $100,000 to $180,000 annually. It works best when your system has matured and usage is consistent.

With this setup in place, let’s look at the advantages and potential limitations of using a Fixed Price Model.

| Pros | Cons |

|---|---|

| Predictable budgeting for finance teams | Limited flexibility for rapid workload changes |

| Simplifies planning and resource allocation | May result in overpayment if usage is lower than anticipated |

2. Consumption-Based Model

This model charges teams based on actual usage metrics, such as CPU hours, build minutes, or storage volumes. It’s often the default setup for cloud-native stacks running on AWS, Azure, or GCP. For early-stage Fintech startups that haven’t stabilized their traffic or workload, this model offers flexibility.

However, as workloads grow, costs can increase rapidly. Teams typically spend $3,000 to $7,000 per month in the initial phase and $10,000 to $25,000 per month once scaling begins. This structure requires regular monitoring to avoid surprise charges.

| Pros | Cons |

|---|---|

| Flexible pricing based on actual usage | Costs can spike unexpectedly as workloads increase |

| Ideal for early-stage or fluctuating workloads | Requires continuous monitoring to prevent budget overruns |

| Avoids paying for unused capacity | Less predictable budgeting for finance teams |

Simply put, the Consumption-Based Model suits FinTech teams that prioritize flexibility and only want to pay for what they use.

3. Tiered Investment Model

This model splits DevOps expenses across product maturity stages: initial setup, growth, and compliance hardening. It’s ideal for FinTech platforms that are still evolving and want visibility into where and when to invest.

During the setup phase (CI/CD, infrastructure as code, cloud provisioning), the cost typically ranges from $30,000 to $50,000 as a one-time investment.

As the platform grows and adds monitoring, scaling, and DevSecOps, monthly costs can increase to $12,000 to $20,000, depending on feature load and integrations. This approach provides financial clarity without overwhelming early budgets.

| Pros | Cons |

|---|---|

| It provides financial clarity at each stage of development. | Requires careful planning to allocate resources correctly |

| This Aligns investment with platform growth and compliance requirements | Upfront setup costs can be significant |

| This helps manage early-stage budgets efficiently | Monthly growth and compliance costs can add up if not monitored |

In short, the Tiered Investment Model is ideal for evolving FinTech platforms that need a structured approach to scaling costs over time.

4. Hybrid Model

A hybrid model combines fixed pricing for core DevOps functions, such as pipelines, backups, and observability, with variable charges tied to usage. It allows predictable monthly budgeting while preserving room for scaling.

On average, Fintech teams using a hybrid model spend $6,000 to $10,000 per month on fixed services and another $5,000 to $15,000 on dynamic usage depending on traffic and releases. This structure works well for midstage companies preparing for rapid growth but still requiring cost oversight.

Here’s a look at the main advantages and limitations of using a hybrid approach

| Pros | Cons |

|---|---|

| Combines predictability with flexibility for scaling workloads | It can be more complex to manage than purely fixed or consumption-based models |

| Allows finance teams to plan fixed costs while adjusting for variable demand | Requires monitoring both fixed and variable costs to avoid surprises |

| Suitable for mid-stage FinTech companies preparing for growth | Unexpected traffic spikes can increase variable costs significantly |

5. Outsourced DevOps Model

This model involves hiring an external DevOps partner or consulting firm to handle pipeline setup, cloud management, and security configuration. It’s especially useful for startups that lack in-house DevOps capacity but still need highly compliant environments.

Budgets for outsourced DevOps usually fall into two brackets:

- Project-based engagements (3–6 months): range between $40,000 and $120,000 depending on scope.

- Ongoing monthly retainers: Typically cost $7,000 to $18,000/month, based on required support hours and expertise level.

| Pros | Cons |

|---|---|

| Access to specialized expertise without hiring full-time staff | Long-term costs can be higher than in-house DevOps |

| Reduces internal workload, allowing the team to focus on product development | Requires strong SLAs and security governance to avoid risks |

| Ensures compliance and security best practices with experienced partners | Less direct control over day-to-day operations and pipeline changes |

While this setup can reduce internal workload, it requires proper SLAs and security reviews to avoid long-term risks.

So here is a question:

Which model is the best fit for your DevOps Journey?

The truth is, there’s no one-size-fits-all answer. The right model depends on your stage, growth pace, and compliance needs. Startups often favor consumption-based or outsourced setups, while scaling teams benefit from hybrid or tiered approaches, and mature platforms rely on fixed models for stability.

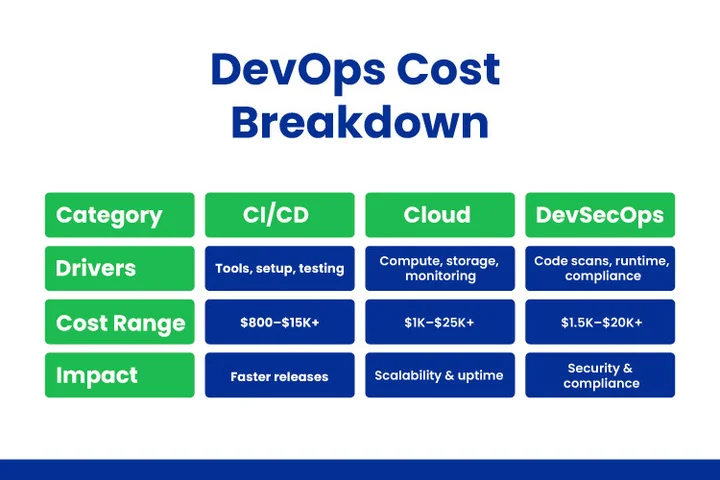

Cost Breakdown of Each DevOps Component in Fintech

Planning for DevOps adoption in a Fintech setting requires a clear understanding of where your money is going. Nearly 29% of organizations now spend more than $12 million annually on cloud services, highlighting the critical need for effective cost management in cloud adoption.

DevOps costs in Fintech are spread across several critical components, each contributing differently to the overall budget.

For example, particular areas include CI/CD pipelines, cloud infrastructure, and security measures, all of which are essential for smooth and compliant operations.

Furthermore, when breaking down DevOps expenses, CI/CD costs involve automation tools and pipeline management, while cloud expenses cover compute, storage, and networking resources. Security costs ensure data integrity and regulatory compliance costs in Fintech.

Below, we will discuss the three core cost centers that dominate DevOps implementation as part of the DevOps cost breakdown 2025:

1. CI/CD Pipeline Cost

Building and maintaining an automated CI/CD pipeline cost factor is at the heart of modern DevOps strategy. For Fintech companies, where rapid feature deployment and zero-downtime releases are critical, a reliable pipeline is non-negotiable.

The main cost drivers are the following:

- Tools & Licensing: Open-source tools like Jenkins are free but require manual setup and maintenance. Managed solutions like GitLab CI/CD, CircleCI, or Harness come with subscription fees, depending on usage and team size.

- Pipeline Configuration & Setup: Initial setup involves integrating repositories, configuring build agents, setting up environment variables, and automating rollback strategies. This often requires hiring DevOps engineers or consultants.

- Testing Automation: Functional, regression, and load testing tools like Selenium, TestNG, or Cypress need to be integrated. QA automation specialists also contribute to this cost center.

CI/CD Pipeline Cost Estimation:

- Small startups: $800–$2,500/month

- Midsized Fintech firms: $3,000–$6,000/month

- Enterprises: $8,000–$15,000+/month

2. Cloud Infrastructure Costs

A flexible and scalable cloud environment forms the backbone of any DevOps setup. Fintech applications demand high availability to ensure uninterrupted service, strong encryption to protect sensitive data, and seamless failover systems for disaster recovery.

In short, these critical requirements directly impact cloud infrastructure costs, often making it one of the largest budget items in DevOps spending.

Major Factors Influencing Cloud Infrastructure Costs:

- Cloud Providers: AWS, Azure, and GCP offer Fintech-optimized services with varying pricing models. Azure provides enterprise compliance integration (like Azure Policy), AWS offers granular IAM controls, and GCP stands out for AI-enabled operations.

- Core Services: This includes compute (EC2, VMs), storage (S3, Azure Blob), networking (VPC, Load Balancers), databases, and container orchestration (EKS, AKS, GKE).

- Monitoring & Recovery: Tools like Datadog, Prometheus, and native cloud monitoring (e.g., CloudWatch, Azure Monitor) track usage, errors, and latency. Backup systems, disaster recovery zones, and autoscaling features add to the ongoing cost.

Estimated Cloud Infrastructure Cost For Fintech:

- Small workloads: $1,000–$3,500/month

- Growing Fintech teams: $4,000–$10,000/month

- Large-scale deployments: $12,000–$25,000+/month

3. DevSecOps & Security Costs

Fintech teams must build “security by design.” Every step of the DevOps process, from source code to runtime, needs to incorporate security procedures. These costs are essential for maintaining compliance with financial regulations like PCI DSS, GDPR, and PSD2.

Important Cost Drivers

- Code Analysis Tools: Static Application Security Testing (SAST) and Dynamic Application Security Testing (DAST) tools like SonarQube, Snyk, or Veracode ensure vulnerabilities are caught early.

- Container & Runtime Security: Scanning Docker images, managing secrets, and detecting anomalies require tools like Aqua Security, Prisma Cloud, or AWS Inspector.

- Access & Compliance Controls: Role-based access, audit logs, secrets management (e.g., HashiCorp Vault), and continuous compliance dashboards contribute to upfront and ongoing expenses.

Estimated Cost Range:

- Entry-level security layer: $1,500–$3,000/month

- Compliance-focused Fintech apps: $4,000–$8,000/month

- Heavily regulated enterprises: $10,000–$20,000+/month

The financial framework of your DevOps implementation is made up of these elements: cloud infrastructure, CI/CD pipelines, and DevSecOps procedures. Knowing where each dollar goes helps Fintech teams prioritize investments, control scaling costs, and meet compliance obligations without overextending budgets.

To better illustrate these expenses, the following table summarizes estimated cost ranges for startups, mid-sized FinTech firms, and enterprises across the 3 primary DevOps components: CI/CD pipelines, cloud infrastructure, and security. These ranges provide a realistic view of how budgets scale as organizations grow.

| Cost Center | Startup (Monthly) | Mid-Sized FinTech (Monthly) | Enterprise (Monthly) |

|---|---|---|---|

| CI/CD Pipeline | $800–$2,500 | $3,000 – $6,000 | $8,000 – $15,000+ |

| Cloud Infrastructure | $1,000–$3,500 | $4,000–$10,000 | $12,000 – $25,000+ |

| DevSecOps & Security | $1,500–$3,000 | $4,000–$8,000 | $10,000 – $20,000+ |

In the next section, you will learn about the DevOps cost in different stages.

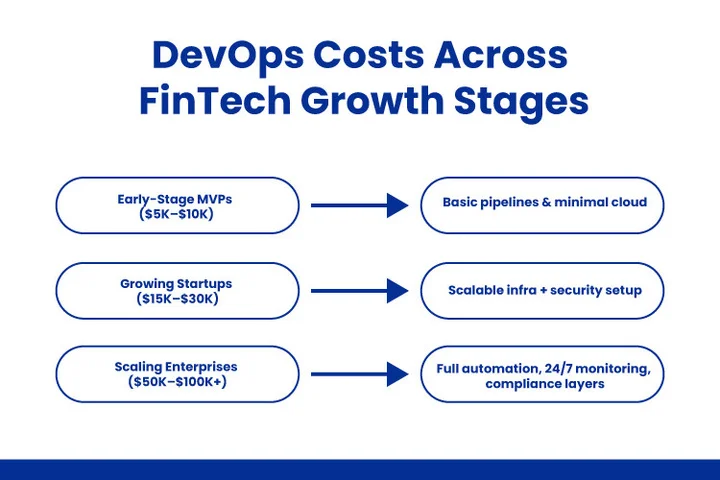

How Much Does DevOps Cost for Different Fintech Stages?

The cost of implementing DevOps in a Fintech organization is closely tied to its maturity stage; each phase brings different priorities, tools, and operational complexities. Your DevOps budget must be in line with your growth curve.

To aid in your better planning, we will explain typical cost expectations below:

a. Early-Stage MVPs

For startups at the MVP or prototype stage, the goal is to build fast, test ideas quickly, and stay compliant without overspending. With budgets typically ranging between $5K and $10K, teams often adopt open-source or freemium DevOps tools and rely heavily on automation to keep operations lean.

Cost Factors:

- Basic CI/CD pipeline setup using tools like GitHub Actions or GitLab CI

- Minimal cloud infrastructure (often pay-as-you-go with AWS or Azure credits)

- Lightweight security scans (open-source tools or basic plugins)

Why it’s inexpensive: You’re establishing a foundation and validating the product idea rather than handling high user traffic or data loads.

Business Outcomes: This approach helps startups ship quickly, stay compliant at low cost, and test product-market fit. By avoiding heavy infrastructure, teams can reduce time-to-market, attract early adopters, and create investor confidence while keeping risk minimal.

b. Growing Startups

As your product gains market traction and your development team expands, infrastructure demands naturally increase. Budgets for this stage usually fall between $15K and $30K, reflecting the need for more complex CI/CD pipelines, scalable cloud environments, and robust compliance measures.

Investments often focus on ensuring stable deployments, achieving near 24/7 uptime, and enhancing data protection to meet evolving customer and regulatory expectations.

Cost Factors:

- Upgraded CI/CD with integrated QA pipelines and rollback features

- Cloud spending increases (compute, storage, autoscaling, backups)

- Introduction of DevSecOps practices (vulnerability scans, IAM policies)

- Greater need for observability tools like Prometheus, Datadog, or New Relic

Why this range fits: You’re still optimizing costs, but reliability and compliance start to take center stage.

Business Outcomes: Here, the focus shifts to reliability, uptime, and customer trust. By investing in better automation

and monitoring, startups can scale safely, maintain compliance, and protect customer data, ensuring smoother growth and higher user retention.

c. Scaling Enterprises

For established Fintech companies, DevOps becomes a strategic pillar rather than a supporting function. With operations spanning multiple locations, handling large-scale workloads, and managing sensitive financial data, budgets often exceed $50K to $100K+. Spending is directed toward advanced automation, continuous security monitoring, disaster recovery planning, and performance optimization.

Moreover, at this level, DevOps investments are closely tied to maintaining competitive advantage, operational resilience, and strict regulatory compliance.

Cost Factors:

- Multiregion cloud environments with advanced networking and DR plans

- Fully automated and modular CI/CD pipelines integrated across microservices

- Continuous security monitoring, audit trails, and zero-trust architectures

- Dedicated DevOps and security engineers or outsourced DaaS providers

Why the jump in cost: The complexity, risk profile, and regulatory demands require enterprise-grade automation, tooling, and expert oversight.

Business Outcomes: At this level, DevOps directly supports regulatory resilience, uptime guarantees, and operational efficiency. Investments enable enterprises to handle large-scale financial workloads, maintain customer confidence, and stay competitive in highly regulated markets.

Once you understand how costs scale with business stages, it’s time to simplify them even further by examining each core component in the DevOps toolchain. We’ll take a look at how CI/CD, cloud infrastructure, and DevSecOps individually impact your budget.

Paying too much for DevOps without seeing the returns you need? Clustox pinpoints your stage and builds a budget plan that matches your goals and compliance needs.

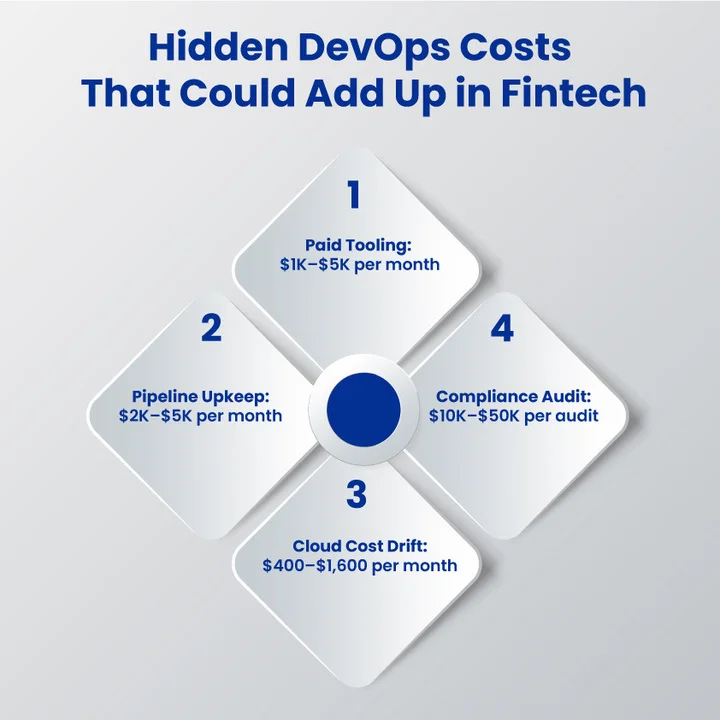

Which Hidden and Ongoing DevOps Costs Are Impacting Your Fintech Budget?

Initial DevOps setup may look like a one-time investment, but in Fintech, ongoing costs keep adding up as compliance needs grow and systems scale. Ignoring these recurring expenses can easily lead to budget overruns and reduced ROI.

Below is a summary of these frequently disregarded elements:

1. Tool Subscriptions and Licenses

While open-source tools exist, enterprise-grade platforms required for Fintech security, scalability, and compliance often come with recurring monthly or annual fees. These tools can include:

- CI/CD platforms (GitLab Premium, CircleCI): $19–$99 per user/month

- Security tools (Snyk, Aqua Security, SonarQube Enterprise): $500–$3,000 annually

- Monitoring & Observability (Datadog, New Relic, Prometheus): $15–$30 per host/month

Licensing models may charge per user, per active pipeline, or per service monitored, which means your costs grow as your team scales or your systems expand. For a mid-sized Fintech team, these subscriptions alone can add up to $10K–$50K annually.

In addition, failing to forecast these licensing expenses can result in budget overruns or restricted tool access when you need it most.

Business impact: Hidden subscriptions can silently pile up and eat into your annual budget. It can cause:

- Unexpected licensing bills disrupt financial planning.

- Limited access to critical tools slows down delivery and weakens security.

- Teams may end up paying for features they don’t fully use.

2. Maintenance of Pipelines

A CI/CD pipeline is not a “set it and forget it” system. Over time, you’ll need to:

- Update build scripts as dependencies change or environments are upgraded.

- Refactor test stages to avoid flaky results or speed bottlenecks.

- Handle tool version upgrades to stay secure and compliant.

Without ongoing maintenance, you risk slower deployments, failed builds, and mounting technical debt. This means allocating engineering hours each month to ensure your automation is up-to-date and aligned with changing product needs.

On average, pipeline maintenance can require 20–40 hours of DevOps engineer time monthly, translating into $2K–$5K in recurring costs.

Business Impact: Neglecting pipeline upkeep directly slows down innovation and creates hidden costs. This leads to:

- Slower releases and missed go-to-market deadlines.

- Higher risk of failed builds and unreliable deployments.

- Increased compliance gaps, exposing fintech platforms to audits and penalties.

3. Cloud Cost Drift

Even with the best intentions, cloud billing can spiral out of control. This drift happens when:

- Dev environments are left running after hours.

- Instances are overprovisioned “just in case.”

- Data transfer and storage grow unchecked.

- Autoscaling triggers during a marketing spike and isn’t rolled back.

While AWS, Azure, and GCP offer cost-monitoring tools, managing drift proactively requires regular audits, automated policies, and cloud FinOps practices, all of which introduce time and tooling expenses.

Unmonitored drift can add $5K–$15K annually in wasted cloud spend, depending on workload and scale.

Business Impact: Unmonitored cloud drift silently drains budgets and reduces ROI. For fintech firms, this means:

- Wasted spending on idle or oversized resources.

- Lower profit margins as infrastructure costs outpace revenue growth.

- Reduced ability to invest in innovation because money is tied up in unnecessary cloud usage.

4. Compliance Audits

Fintech platforms are subject to regular audits, including GDPR compliance checks, annual SOC 2 reviews, and quarterly PCI DSS scans. These audits require:

- Comprehensive logging of changes and access

- Historical records of deployment pipelines and configs

- Proof of secure coding practices and vulnerability management

DevOps teams are often tasked with preparing compliance documentation, building audit-friendly automation, or responding to security questionnaires. These efforts are time-intensive and often recur annually, if not more frequently.

Compliance-related DevOps activities typically cost $10K–$30K per year, covering both engineer hours and audit tools.

Business Impact: Neglecting compliance audits can result in severe financial and reputational risks.

- Failing audits may trigger fines, penalties, or loss of certifications.

- Engineering hours get diverted away from innovation, slowing product delivery.

- Costs accumulate annually, leading to budget strain if not planned.

- Missing compliance deadlines can stall launches or block critical partnerships.

Many FinTech teams underestimate these ongoing DevOps costs until they start piling up and hurting growth. This is where having the right partner makes the difference. Clustox helps you spot hidden expenses before they snowball, guiding you with clear visibility into every step of your DevOps journey.

Our professionals make sure your budget stays optimized while your platform stays safe and scalable, handling everything from tool licensing to pipeline maintenance, cloud cost drift, and compliance audits. You’re staying ahead of surprises when you have Clustox on your side, rather than just responding to them.

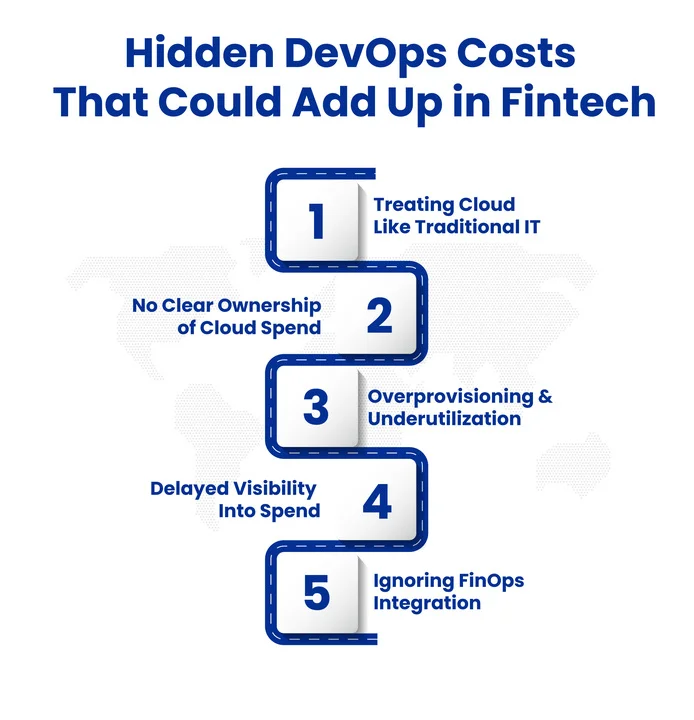

Which Common Mistakes Are Fintechs Making in Their 2025 DevOps Budget?

As Fintech platforms mature in 2025, their reliance on cloud-native tools, containers, CI/CD pipelines, and real-time analytics continues to grow. However, Errors in DevOps budgeting have a direct impact on uptime, performance, compliance, and innovation velocity; they are not merely line-item problems.

In fact, the global DevOps market is expected to expand from USD 16.13 billion in 2025 to USD 43.17 billion by 2030, reflecting a 21.76% CAGR that highlights both opportunity and cost complexity.

Moreover, FinOps practices are designed to create visibility and accountability for cloud spending. But unless budgeting is tied into engineering workflows and real-time usage data, Fintechs risk scaling inefficiently, misusing cloud resources, and burning through capital faster than they can generate returns.

Fintechs continue to make the following five budgeting errors, and it’s important to avoid them:

1. Treating Cloud Budgets Like Traditional IT Spending

Many Fintechs still treat cloud budgets like traditional IT spending, assuming they can be planned annually or quarterly. However, cloud-native DevOps runs on usage-based pricing, where resources scale dynamically with demand.

In 2025, this shift means forecasts based only on headcount or user growth often miss key variables. Unlike traditional models with fixed infrastructure, the cloud introduces ephemeral workloads, spot instances, autoscaling, and region-based pricing.

Why Does It Hurt Fintech?

- Cost overruns happen silently: Without real-time monitoring, cloud bills may exceed projections before finance teams are even aware.

- Investor confidence erodes: VCs expect Fintechs to be lean and metrics-driven. Outdated budgeting shows poor cost discipline.

- Engineering decisions get disconnected from financial impact: When budgeting isn’t agile, engineers operate in a vacuum, unaware of cost implications for infrastructure or deployment choices.

2. No Clear Ownership of Cloud Spending

One of the most frequent (and costly) mistakes in Fintech DevOps teams is not assigning direct ownership over cloud costs. When no one is accountable, everyone assumes it’s someone else’s responsibility.

In many Fintech organizations, engineering teams spin up new environments, deploy microservices, and autoscale containers without thinking about budgets. Meanwhile, finance teams often lack technical visibility into where the money is going.

Why Does It Hurt Fintech?

- Cloud bills become a black box: Without cost attribution, you can’t pinpoint which teams, features, or services are burning budget.

- No incentive to optimize: Engineers may choose the most powerful (and expensive) instance types just to avoid performance complaints, even if they’re not needed.

- Scaling becomes chaotic: As Fintechs grow, multiple teams deploying independently can cause budget ballooning without anyone noticing.

In successful FinOps cultures, cost is a shared responsibility. Fintech teams that establish accountability early, especially for DevOps-managed resources, tend to optimize faster, scale smarter, and avoid financial surprises.

3. Overprovisioning and Underutilized Cloud Resources

In the pursuit of performance and uptime, many Fintech DevOps teams overprovision compute, storage, or bandwidth. What starts as a safety measure often turns into hidden cloud waste, with idle VMs, oversized Kubernetes nodes, underutilized databases, and pre-scaled services that never meet projected usage.

Why Does It Hurt Fintech?

- Burns through startup runway: Especially for early-stage Fintechs, inefficient provisioning can deplete funding before product-market fit is achieved.

- Hides real usage patterns: When resources are overallocated, it becomes difficult to understand actual load and performance baselines.

- Blocks optimization efforts: Teams assume they “need” high-powered infrastructure, even when usage metrics suggest otherwise.

Most importantly, overprovisioning is an ongoing risk. That’s why FinOps encourages continuous monitoring and optimization as part of the DevOps lifecycle, not as an afterthought during budget reviews.

4. Delayed or Fragmented Visibility Into Cloud Spend

One of the biggest challenges in Fintech DevOps budgeting is the lack of cost visibility. As a result, teams often face end-of-month cloud bills with unexpected spikes, untagged resources, or expenses that can’t be tied to a project.

In turn, this gap in real-time insight leads to reactive budgeting, where instead of preventing issues, finance and engineering scramble to justify costs after they occur.

Why Does It Hurt Fintech?

- Missed optimization windows: By the time a cost anomaly is detected, days or weeks have passed.

- No accountability: Without tagging, metering, and real-time dashboards, it’s impossible to trace costs back to specific teams, features, or initiatives.

- Poor forecasting: Historical data becomes unreliable when costs are lumped together or spread across misconfigured accounts.

- Loss of trust between teams: Finance suspects overspending, and engineering feels micromanaged.

The goal is to shift from “finance vs. engineering” to “engineering with financial context.” FinOps empowers Fintech companies to turn cloud costs into strategic choices, but only when those choices are made together.

How Can You Optimize Cost for Fintech DevOps Services in 2025: Tips & Tricks

Controlling DevOps services costs has become increasingly essential for Fintech firms, given the rising demand for cloud usage and complex infrastructure requirements. For instance, regularly monitoring resource consumption allows teams to identify and eliminate waste.

Moreover, Automation also plays a key role; automating deployment pipelines and security scans reduces manual effort, which lowers operational costs and minimizes errors.

Furthermore, integrating cost awareness into engineering workflows helps balance budget constraints with performance needs. Teams that maintain close collaboration between finance and DevOps avoid overspending on unnecessary infrastructure while preserving compliance standards.

In the following section, you have to go through the cost optimization tips or learn how to overcome the common pitfalls.

1. Monitor Cloud Usage Continuously

Tracking cloud usage helps identify idle resources that waste money. Real-time monitoring allows teams to quickly shut down or resize these resources, preventing unnecessary costs. Regular reviews ensure budgets stay aligned with actual demand, avoiding surprises in cloud spending.

Impact on FinOps:

- Drives financial accountability within teams.

- Enables proactive cost control and prevents overspending.

- Supports transparent cost allocation and reporting.

- Improves collaboration between finance and engineering.

- Enhances accuracy in budgeting and forecasting.

This approach strengthens FinOps by connecting technical actions with financial outcomes.

2. Automate Repetitive Tasks/h3>

Automating CI/CD pipelines and security checks reduces manual effort and lowers operational costs. It speeds up deployments and minimizes human errors. Automation ensures consistent quality while freeing teams to focus on strategic priorities.

Impact on FinOps:

- Cuts down labor costs associated with repetitive tasks.

- Reduces risks of costly mistakes.

- Accelerates delivery without increasing budget.

- Enables more predictable resource usage.

- Fosters a culture of efficiency and cost-awareness.

This approach allows Fintech teams to deliver faster while keeping costs under control.

3. Right-Size Cloud Instances

Regularly adjusting cloud resources to match workload demands prevents overspending. Avoiding oversized instances cuts unnecessary expenses while maintaining required performance levels. Rightsizing helps allocate the budget more effectively.

Impact on FinOps:

- Eliminates waste from overprovisioned resources.

- Improves cost transparency and control.

- Aligns infrastructure spending with business needs.

- Supports continuous budget optimization.

- Encourages responsible resource management.

Consistent rightsizing is essential for balancing cost efficiency with operational performance.

4. Enforce Cost Ownership/h3>

Assigning clear budget responsibility to specific teams boosts accountability. Using tagging and reporting tools helps teams track their cloud expenses. Cost of ownership promotes mindful consumption and smarter spending decisions.

Impact on FinOps:

- Creates transparency in cloud costs across teams.

- Motivates teams to optimize their resource use.

- Helps identify cost drivers and areas to improve.

- Enables more accurate chargeback or showback models.

- Strengthens collaboration between finance and engineering.

Clear ownership ensures teams stay accountable and budgets remain optimized.

5. Integrate FinOps Practices

Embedding FinOps principles into workflows aligns spending with business priorities. It fosters collaboration between finance and engineering, promoting shared responsibility for cost management. Continuous optimization becomes part of the DevOps lifecycle.

Impact on FinOps:

- Bridges the gap between technical and financial teams.

- Improves budgeting accuracy and forecasting.

- Encourages strategic cost decisions.

- Enhances agility without sacrificing financial control.

- Supports sustainable growth through informed spending.

Integrating FinOps enables smarter, data-driven financial decisions across the organization.

Want to cut your Fintech DevOps costs without risking performance? We optimize the cloud, automate workflows, and apply FinOps to keep your infrastructure lean, secure, and efficient.

Continue reading to get to know how you can plan your DevOps budget wisely!

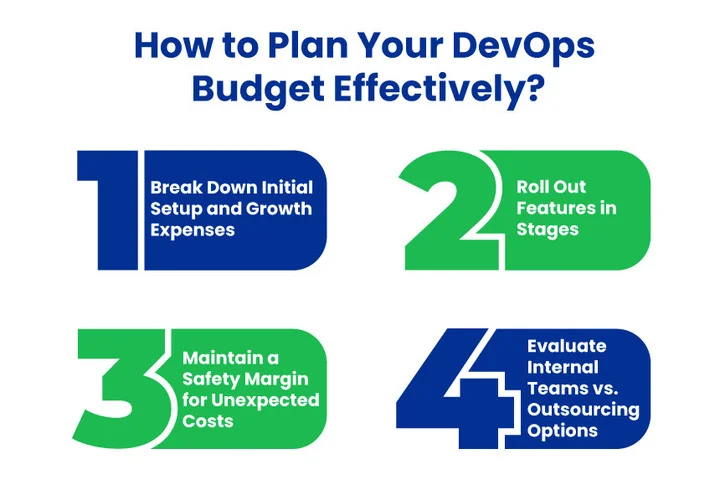

How Can You Estimate and Plan Your DevOps Budget Wisely?

Allocating your DevOps budget strategically is more important than simply spending it. Startups often fall into the trap of overspending on tools they don’t need or underestimating the costs of scaling later.

Ultimately, a well-structured budget gives you financial clarity, minimizes waste, and helps you make decisions based on value rather than guesswork. You can improve your cost management by keeping the following things in mind, whether you’re creating your first CI/CD pipeline or getting ready for expansion.

Clustox helps startups budget smartly by focusing on the essentials first and scaling wisely. Here are four ways you can take control of your DevOps spending:

1. Separate Setup from Scaling Costs

Your MVP or initial product launch, requires only foundational DevOps practices like version control, basic CI/CD, and automated testing. But once your user base grows, you’ll need to invest in high-availability setups, stronger security, and advanced monitoring.

Plan for both phases early so you’re not caught off guard during scale-up.

For example, start with infrastructure provisioning and CI pipelines, then move to security automation and full observability later.

3. Keep a Contingency Buffer

Projects rarely go exactly as planned. Tech debt, changing requirements, or compliance needs can quickly shift your budget. Set aside an additional 15–20% as a buffer to avoid delays or compromises when unexpected costs arise.

4. Decide Between In-House vs. External Help

Hiring a full DevOps team early on may stretch your budget. Cloud DevOps consulting for Fintech firms like Clustox brings ready-to-adapt frameworks, cloud automation libraries, and proven implementation strategies that save time and reduce long-term costs. It’s often a smarter choice than starting from scratch internally.

How Does Clustox Approach DevOps Consulting for Startups?

Startups require scalable foundations, quick deployment cycles, and predictable cloud spending, not overly complex solutions. At Clustox, we approach DevOps consulting with one goal: helping early-stage and scaling startups build the right infrastructure for today’s goals while preparing for tomorrow’s growth.

Our approach combines technical precision with business context. Instead of throwing tools at problems, we assess what’s already working, what’s slowing you down, and what can be optimized.

Moreover, we assist you in achieving quicker delivery, improved teamwork, and more economical operations, regardless of whether your team ships twice a week or finds it difficult to implement features monthly.

To achieve this, Clustox follows a structured DevOps process customized for startups:

1. Initial Discovery & Needs Assessment

The process begins with a deep dive into your current setup with an understanding of your codebase, cloud environment, deployment pipelines, tooling, and team structure. Finding friction points is made easier with the aid of this discovery phase.

This step establishes the foundation for a practical DevOps strategy, regardless of whether you are pre-product or post-MVP.

2. Tech Stack & Workflow Alignment

Clustox doesn’t push a standard toolset. Instead, it aligns DevOps implementation with the technologies you’re already using, be it AWS, Azure, GitHub Actions, GitLab CI/CD, or Kubernetes.

In practice, the idea is to enhance what works for your team, not replace it. Any new components, like Terraform, Helm, or Prometheus, are introduced only if they address a clear gap in performance, automation, or monitoring.

3. DevOps Roadmap Design

After understanding the current state and aligning with your stack, Clustox designs a customized DevOps roadmap. This includes prioritized action items, automation goals, scalability checkpoints, and security controls.

In short, the roadmap is flexible, measurable, and startup-friendly, allowing you to grow with it without being locked into unneeded complexity.

4. Implementation & Automation Setup

This is where infrastructure as code, CI/CD pipelines, containerization, and automated testing come into play. Clustox ensures your releases go from idea to production in hours, not weeks, by automating infrastructure, CI/CD pipelines, containerization, and testing. This reduces manual effort, accelerates release cycles, and improves deployment reliability.

With experience serving 20+ FinTech clients, Clustox has consistently helped teams cut deployment times by up to 60% while maintaining strict compliance standards. Our team holds industry-recognized certifications in AWS, Kubernetes, and DevSecOps, ensuring automation is secure, scalable, and tailored to your business needs.

In simple words, the goal is to create pipelines that developers enjoy using as fast, stable, and easy to troubleshoot.

5. Cost Optimization & Monitoring Integration

FinOps visibility is part of the process. Clustox integrates cloud cost tracking tools, sets up usage-based alerts, and ensures you can monitor your infrastructure in real time. The focus is on helping startups avoid hidden spending and scale efficiently without budget surprises.

Additionally, the licensing, compute sizing, and storage allocation are all optimized to fit your burn rate and growth targets.

6. Ongoing Support & Iteration

Clustox provides continued support for DevOps iterations based on your evolving product and traffic. As your team scales, the setup is reevaluated to ensure it’s still aligned with performance, cost, and security goals. With every new sprint, release, or infrastructure update, Clustox stays in the loop to fine-tune configurations and guide decisions.

Key Takeaways

In Fintech, DevOps directly drives speed, security, and scalability. In 2025, the cost of building and maintaining this capability often falls between $150,000 and $300,000 annually for mid-sized firms.

However, these budgets typically cover CI/CD pipelines, cloud infrastructure, and security layers but can easily exceed expectations if cloud usage is not optimized, compliance gaps emerge, or automation is delayed.

But without a clear budgeting strategy, platforms risk slower release cycles, unpredictable expenses, and higher operational risks. The way forward is to plan DevOps spending as a growth investment.

This involves choosing the right cost model, tracking ongoing expenses, addressing hidden costs, and embedding practices like cloud rightsizing, automated monitoring, and DevSecOps. By doing so, Fintech teams can achieve predictable budgets, faster delivery, and stronger compliance without sacrificing innovation.

The result?

Predictable costs, improved performance, and a DevOps framework that supports both short-term goals and long-term scalability.

That is where Clustox can help you. We work with Fintech startups and scaling enterprises to provide cloud cost estimation for Fintech startups and build cost-smart, performance-driven DevOps strategies. Our approach covers everything from optimizing cloud resources and automating pipelines to integrating FinOps for long-term efficiency.

To help you get started, we’ve created a Cloud Cost Optimization Checklist that outlines practical steps to reduce waste, improve efficiency, and ensure your budget fuels innovation instead of draining it.

Frequently Asked Questions (FAQs)

2. Is DevOps expensive for Fintech firms?

It can be if costs aren’t monitored. However, when planned strategically, DevOps is an investment that improves delivery speed, compliance, and scalability, often saving money in the long run.

3. What influences DevOps costs in Fintech?

DevOps costs depend on the scale of operations, level of automation, and compliance needs. In Fintech, stricter regulations and higher uptime demands often increase expenses.

Key factors affecting DevOps costs:

- Cloud infrastructure

- Pipeline complexity

- Security and compliance

- Team expertise

- Monitoring tools

4. How can Fintechs avoid overspending on DevOps?

Adopt FinOps practices, track cloud usage in real time, right-size instances, assign budget ownership, and run regular audits of tools and pipelines.

5. Is it better to build an in-house DevOps team or outsource?

Startups often save time and costs by outsourcing to experts, while larger teams may prefer in-house engineers for faster, on-demand updates. A hybrid approach works well for many.

6. How often should DevOps budgets be reviewed?

Regular reviews catch anomalies early and keep spending aligned with growth, compliance, and project priorities, ensuring resources are used efficiently and strategically.

Recommended frequency:

- Monthly: Identify unusual costs before they escalate.

- Quarterly: Adjust budgets for new projects, compliance updates, or scaling needs.

Your DevOps budget deserves clarity. Clustox works with startups to define costs, align resources, and scale confidently.

Fantastic read! This article provides a detailed breakdown of DevOps costs in fintech, covering CI/CD, cloud, and security expenses. Very practical and insightful for teams planning their 2025 budgets effectively.