You’re sitting at your kitchen table on a Sunday morning, sipping coffee and scrolling through your bank app.

You point your phone at your latest statement, and, instead of a static list of numbers, colorful 3D charts pop up showing exactly where your money went last month. A virtual banker appears on-screen, walking you through your savings plan, all without you stepping into a branch.

This isn’t a gimmick from a sci-fi movie; it’s what Augmented Reality (AR) is making possible in banking and financial services right now.

By blending digital information into the real world, AR is transforming static financial data into interactive experiences, enabling customers to make smarter decisions and providing banks with new ways to operate more efficiently.

This surge isn’t just hype.

In fact, the global AR in the BFSI market was valued at around USD 994.6 million in 2023 and is projected to grow at a CAGR of about 24.6% through 2030, reaching nearly USD 4,637 million.

In this blog, we will explore 10 real-world AR use cases that are transforming the way people bank, borrow, invest, and insure in 2026.

So, let’s get started!

Table of Contents

How Augmented Reality is Shaping the BFSI Sector?

Augmented reality AR in financial services is increasingly transforming the BFSI (Banking, Financial Services, and Insurance) sector by improving both customer experiences and operational efficiency.

Instead of static apps or paper forms, customers can now use AR-powered tools to visualize their financial goals, explore virtual bank branches, or receive real-time guidance from advisors, making everyday banking more interactive and intuitive.

Augmented reality in finance also delivers value behind the scenes. It’s becoming a powerful tool for staff training and compliance, allowing employees to practice real-world scenarios safely and improve decision-making accuracy.

In the insurance space, AR enables remote property inspections, accelerates claims processing, and reduces operational delays and errors, ultimately saving time and improving service quality.

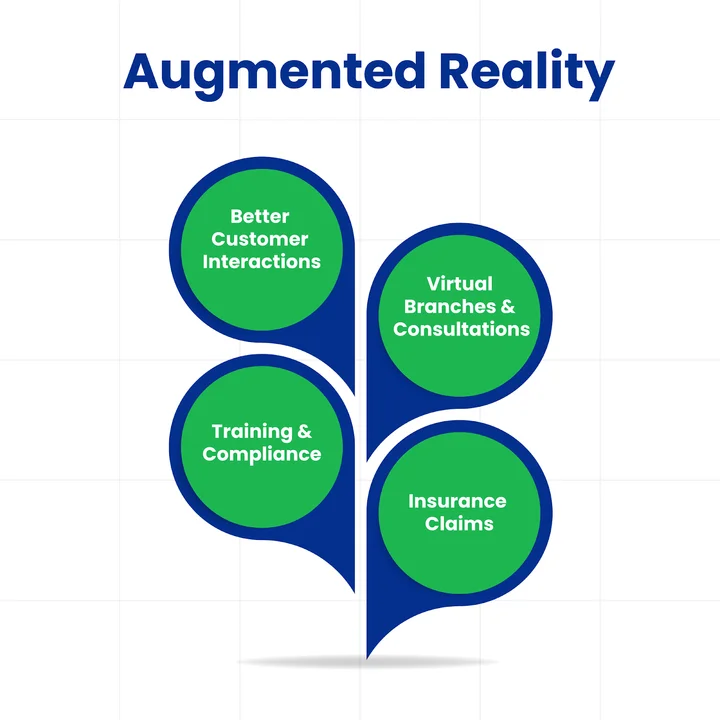

Here are your AR applications in BFSI:

- Better customer interactions: AR can make banking apps more interactive, allowing users to visualize transactions, savings goals, or investments.

- Virtual branches and consultations: Customers can experience augmented reality bank tours or meet advisors via AR, creating a more immersive banking experience.

- Training and compliance: AR helps bank staff simulate complex scenarios, improving learning outcomes and reducing operational errors.

- Insurance claims: AR allows remote inspections, speeding up claims processing and improving accuracy.

These applications do more than simplify tasks; they actively reshape customer engagement, optimize processes, and drive data-driven insights. BFSI companies are putting themselves at the forefront of digital transformation and improving convenience by incorporating AR.

Reduce onboarding errors and delays with expert-managed account setups that keep your customers moving without interruptions.

With a clear understanding of how AR is transforming the BFSI sector, let’s explore its practical applications, starting with how it is revolutionizing customer onboarding!

Use Case 1: AR in Banking for Customer Onboarding

Traditional customer onboarding in banking can be a time-consuming process. Augmented reality for banking transforms this process by providing interactive guidance and real-time assistance, allowing customers to complete onboarding quickly and efficiently.

Through AR-enabled apps, users can scan their documents, follow visual prompts, and submit information effortlessly, without the need to visit a branch.

Example Scenario:

Imagine a new customer downloading a bank’s mobile app. As they start the onboarding process, the AR feature overlays instructions directly onto the camera view, highlighting where to enter personal information and verifying documents in real time.

The app can even confirm the successful submission of forms instantly, eliminating confusion and delays. This approach not only speeds up onboarding but also raises the overall customer experience and reduces errors in the process.

Use Case 2: Virtual Branch Experiences

Visiting a physical bank branch can be time-consuming, especially for customers in remote areas or with tight schedules. Augmented Reality (AR) is redefining this experience by offering virtual branch interactions that replicate the in-branch expertise without the need to travel.

Through AR-enabled apps, customers can navigate a virtual banking environment, access information about products and services, and interact with advisors in real-time, all from the comfort of their own homes.

Example Scenario:

A customer interested in opening a new account can launch the bank’s AR app and walk through a virtual branch, exploring different sections as if they were physically present. The app enables users to speak with a virtual advisor, ask questions about loans or investments, and complete transactions directly within the AR environment.

This creates a highly immersive and personalized banking experience, improving engagement while reducing operational costs for banks.

Use Case 3: AR in Financial Data Visualization

Investors and financial analysts often work with complex datasets, dashboards, and market trends that can be overwhelming on standard screens. Augmented Reality (AR) can transform this experience by presenting financial data in a 3D, interactive format, making insights more intuitive and actionable.

With AR-enabled tools, users can visualize stock trends, portfolio performance, and market correlations in a spatial, interactive environment.

Example Scenario:

An analyst monitoring multiple portfolios can use an AR headset to view a 3D map of global market activity. Interacting with individual data points, like zooming in, filtering, or linking related metrics, can uncover insights faster than with traditional dashboards.

Investors can also simulate “what-if” scenarios visually, helping them make informed decisions with greater confidence.

This approach not only enhances understanding of complex financial data but also improves collaboration, as teams can explore and discuss interactive datasets in a shared AR space, reducing misinterpretation and speeding up decision-making.

Use Case 4: Augmented Reality for Payments and Transactions

Traditional payment methods often require multiple steps, such as entering card details, confirming OTPs, and navigating through banking apps. Augmented Reality simplifies and streamlines transactions by creating interactive, intuitive payment experiences.

Customers can use AR-enabled apps to scan items, visualize costs, and complete payments in real time, reducing friction and improving convenience.

Example Scenario:

Imagine a customer shopping in a store or paying a bill at a café. Using the bank’s AR app, they can point their phone at a QR code or the product, instantly view the amount due, and authorize the payment with a simple AR overlay confirmation.

This removes the need for multiple app screens or card swipes, making transactions faster, more secure, and visually engaging.

Use Case 5: AR in Wealth and Investment Management

Managing wealth and investments often involves analyzing complex data, charts, and market trends, which can be overwhelming for many customers. Augmented Reality (AR) makes this process more intuitive and engaging by allowing users to visualize their investment portfolios, track market movements, and explore financial scenarios in 3D.

By overlaying data in a visual, interactive way, AR helps customers make more informed decisions and understand the impact of their investment choices.

Example Scenario:

A customer using an AR-enabled banking app can view their portfolio as interactive 3D graphs, showing the performance of stocks, mutual funds, or retirement accounts. They can simulate changes, such as increasing investment in a particular fund, and instantly see projected outcomes through AR visualizations.

This not only improves understanding but also empowers customers to take proactive financial decisions with confidence.

Use Case 6: AR-Modified Accounting and Audit Processes

Accounting and auditing are critical yet time-consuming operations for financial institutions. Augmented Reality (AR) automates these processes by overlaying digital financial data onto physical documents, systems, or workspaces, enabling accountants and auditors to visualize, verify, and analyze information more efficiently.

Many banks still rely on outdated accounting platforms and core systems. By combining AR features with legacy software modernization services, banks can upgrade these systems, enabling faster audits and interactive analytics.

AR reduces human errors, speeds up reconciliation, and provides a more interactive way to monitor financial activities.

Example Scenario:

An auditor reviewing a company’s financial records can use an AR-enabled device to scan physical invoices or ledgers, instantly overlaying real-time analytics and discrepancies directly onto the documents.

This enables the auditor to quickly identify inconsistencies, compare historical data, and generate reports without needing to toggle between multiple systems. The result is faster, more accurate audits and improved operational efficiency.

Use Case 7: AR for Personalized Financial Advisory

Providing personalized financial advice can be challenging, especially when customers need to understand complex investment strategies or financial plans. Augmented Reality (AR) advances this process by creating interactive, visual experiences that simplify financial guidance and advice.

Customers can view their financial data, goals, and recommendations in an immersive format, making it easier to understand and act on the advice.

Example Scenario:

A customer planning for retirement can use an AR-enabled banking app to visualize different savings and investment scenarios. The app overlays projections, showing how adjustments in contributions or investment choices affect their future wealth.

Advisors can guide clients in real-time, pointing out key insights directly within the AR interface. This approach not only improves understanding but also builds trust and engagement between the customer and the financial institution.

Use Case 8: AR in Fraud Detection and Risk Management

Detecting fraud and managing risk are top priorities for financial institutions, but traditional methods can be slow and reactive. Augmented Reality (AR) extends these processes by visualizing suspicious activities and anomalies in real-time, allowing banks to identify risks more quickly and make informed decisions.

AR overlays actionable insights directly onto transaction data, customer profiles, or operational dashboards, making monitoring more intuitive and proactive.

Example Scenario:

Using an AR-powered tool like FraudVision AR, bank analysts can scan transactions and accounts through AR interfaces, instantly highlighting unusual patterns or potential fraud. The system can visualize high-risk transactions, suspicious behaviors, and real-time alerts, enabling the risk management team to respond immediately.

This approach not only reduces fraud losses but also improves operational efficiency and customer trust.

Use Case 9: AR-Driven Customer Engagement and Marketing

Marketing and customer engagement are evolving rapidly, and Augmented Reality (AR) provides financial institutions with a means to create immersive, interactive campaigns that capture attention and drive engagement.

Banks can provide individualized experiences, inform consumers about financial products, and build up customer engagement and retention by incorporating augmented reality (AR) into their apps, websites, or marketing collateral.

Example Scenario:

A bank launching a new savings account can use AR to let customers visualize how their savings grow over time through interactive 3D charts and animations. Customers can also explore loan options, investment plans, or credit card benefits via AR experiences directly on their smartphones.

These interactive campaigns not only increase brand engagement but also encourage informed financial decisions.

Use Case 10: AR in Mobile and Online Banking Apps

Mobile and online banking have become essential for everyday financial management, but many users still struggle to navigate complex interfaces or understand detailed financial information.

Augmented Reality (AR) helps these platforms by overlaying contextual information, visual cues, and interactive elements directly onto the user interface, making banking more intuitive, engaging, and accessible.

Example Scenario:

A customer using a banking app can point their phone at their account dashboard and see AR overlays highlighting upcoming bills, recent transactions, or spending trends. The app might also provide interactive tutorials, guiding users through features such as fund transfers, bill payments, or investment tracking.

Banks can improve user experience, decrease errors, and increase engagement by incorporating augmented reality (AR), which transforms traditional digital banking into a dynamic and visually engaging experience.

Frequently Asked Questions

2. How can Banks Start Implementing AR in their Services?

Banks usually begin with small, high-impact pilots, such as AR-guided customer onboarding or virtual branch tours, before expanding to larger initiatives. Success typically depends on having secure, scalable infrastructure (such as cloud-based systems and DevOps pipelines) and a clear user experience strategy.

3. What Benefits Does AR Offer to Customers of Banks and Financial Institutions?

Augmented Reality makes everyday banking easier and more engaging. Here's how customers directly benefit:

- Quicker onboarding and support with step-by-step AR guidance

- Clearer insights through real-time visualizations of spending or savings

- Remote access to virtual branches and advisors from anywhere

- Stronger engagement with immersive demos of new products

4. Are There Security or Compliance Concerns With AR in Banking?

Yes. Any digital interaction in financial services must comply with strict data privacy, security, and regulatory standards. When implementing AR, banks need strong authentication, encrypted data handling, and continuous monitoring to ensure compliance, often supported by robust cloud and DevOps practices.

5. Which AR Use Cases Deliver the Fastest ROI for Banks?

Some AR uses pay off almost immediately, such as:

- Customer onboarding

- Virtual branches

- Staff training

- Remote claims

Focusing on these areas enables banks to see results more quickly.

The Bottom Line: How Can Banks Scale AR in 2026?

As augmented reality in the BFSI market continues to reshape banking and financial services, the biggest challenge isn’t what to build; it’s how to scale securely and cost-effectively. Legacy systems, siloed data, and fragmented customer journeys can make it hard to deploy immersive technologies.

The solution?

Partner with teams that understand both cutting-edge technology and the nuances of financial services. At Clustox, we’ve helped organizations in the Fintech software development industry to modernize their platforms and create scalable, customer-centric solutions, such as mobile reality features and cloud-native infrastructure to support them.

Banks can speed up the transition from pilots to production and realize the full return on investment (ROI) of AR by fusing cutting-edge engineering techniques with solid industry knowledge in 2026 and beyond.

Catalyze AR adoption and launch secure, high-performing experiences up to 3x faster with platform modernization.

Share your thoughts about this blog!