Have you ever sent money to a friend and wished it could happen instantly, without waiting for the bank?

That’s exactly what peer-to-peer (P2P) payment networks let you do. These platforms move money directly from one person to another, often with just a few taps on a mobile app.

In 2026, P2P payment networks are at the forefront of fintech innovation in payments, transforming how individuals and businesses conduct financial transactions. By facilitating direct transfers between users, bypassing traditional banking intermediaries, P2P systems offer a more efficient alternative to conventional payment methods.

In fact, the global digital payment market is projected to reach USD 180.2 billion by 2026, growing at a CAGR of 15.4%. For fintech startups in 2026, adopting Peer-to-peer payment systems presents numerous advantages, including reduced transaction costs, enhanced user experience, and the ability to scale operations rapidly.

However, this growth trajectory is accompanied by challenges such as security concerns, regulatory compliance issues, and the need for robust infrastructure to handle increased transaction volumes. Startups hoping to successfully use P2P networks must comprehend these dynamics.

This blog highlights the 7 pros and cons of P2P payment networks that fintech startups must understand to thrive in the evolving payment network trends of 2026.

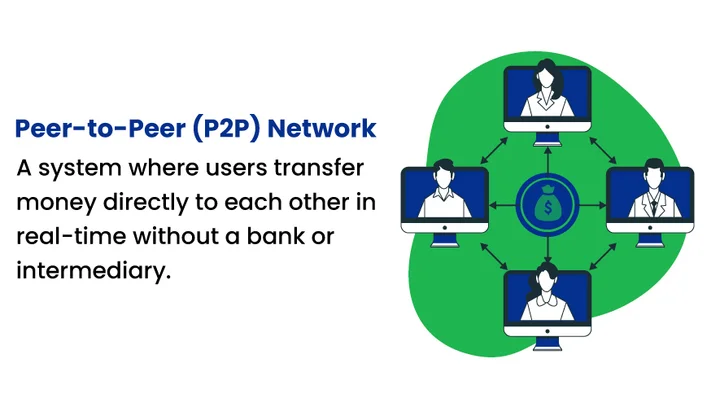

What Is a Peer-to-Peer P2P Network?

A peer-to-peer (P2P) network is a system where participants connect and exchange value directly with one another, without relying on a central authority such as a bank or clearinghouse. In digital payments, it means money moves straight from one user’s account or wallet to another’s in real time, usually through a mobile app or online platform.

These platforms move money directly from one person to another, often with just a few taps on a mobile app, showcasing the capabilities of fintech services in facilitating effortless transactions.

Table of Contents

Essential Features of P2P Payment Networks are:

- Direct transfers between users with no central intermediary

- Real-time or near-instant settlement of funds

- Lower P2P transaction fees compared to traditional payment systems

- App-based access through mobile devices or digital wallets

- Scalable for Cross-border peer-to-peer transfers

Unlike traditional payment systems that route every transaction through intermediaries, P2P payment networks decentralize the process. This makes transfers faster, more convenient, and often less expensive, features that are especially attractive to fintech startups in 2025.

This foundation sets the stage for understanding the benefits and risks of P2P networks, which we’ll cover in the next sections.

You can now launch a secure P2P payment app in 90 days! Our team helps fintech startups cut costs by up to 60% and get to market 3x faster.

7 Important Pros and Cons of Peer-to-Peer (P2P) Payment Networks Every Fintech Startup Should Know in 2026?

Peer-to-peer (P2P) payment networks have quickly become a cornerstone of modern digital finance, giving fintech startups faster, lower-cost, and more user-friendly alternatives to traditional banking channels.

This shift isn’t small!

A recent report by Precedence Research, the global P2P payment market is projected to grow at a compound annual growth rate (CAGR) of 18.10% from 2025 to 2034, expanding from approximately USD 3.63 trillion in 2025 to reach about USD 16.21 trillion by 2034.

As we move into 2026, understanding both the benefits and the pitfalls of P2P systems is essential. They promise real-time transfers, easier cross-border access, and smoother customer experiences, but they also introduce security, regulatory, and scalability challenges that fintech startups can’t afford to overlook.

The following table highlights the main advantages and challenges of P2P payment networks in 2026, helping you quickly see where the opportunities and risks lie.

| Aspect | Pros (P2P Networks) | Cons (P2P Networks) |

|---|---|---|

| Transaction Costs | Cuts fees from ~2–3% on cards to 0.5–1%, making small and high-volume payments viable. | Cross-border or network charges can still add 0.5–2%, reducing savings. |

| Speed & Convenience | Near-instant settlement (seconds instead of days) improves user experience and cash flow. | Irreversible transfers make errors or fraud harder to recover. |

| Cross-Border Payments | Multi-currency wallets and local partners can expand global reach faster than SWIFT. | Complex, varying KYC/AML rules slow international rollout. |

| Security | Tokenization and encryption reduce card data exposure. | Social engineering and account takeover risk remain high without strong verification. |

| Regulatory Environment | Some regions allow lighter licensing at first, enabling quick rollout. | Sudden regulatory changes (e.g., PSD3 or stricter AML) increase compliance costs. |

| Scalability & Network Effects | More users lower average transaction costs and increase liquidity. | Poor infrastructure at peak volumes can damage trust and retention. |

| Customer Support & Disputes | In-app tools can resolve simple disputes faster than banks. | Lack of built-in chargebacks or escrow frustrates customers in complex cases. |

Final Thoughts: Maximizing P2P Payment Growth While Ensuring Security in 2026

As P2P payment networks and mobile payment apps continue to grow in 2026, fintech startups face the challenge of balancing speed, security, and user experience. At the same time, many of the issues, like delayed transfers, cross-border complications, or accidental errors, can be addressed by building a reliable mobile platform that handles real-time transactions smoothly.

For instance, if your startup is looking to create such an app, Mobile App Development services can support your goals by providing scalable, secure, and user-friendly solutions. This approach ensures that technology works for you, rather than creating more headaches for your team or your users.

Focusing on robust mobile infrastructure not only ensures faster transactions but also improves customer trust, reducing the likelihood of disputes or system failures. Moreover, a carefully designed platform can adapt to evolving market needs, making your payment solution more resilient over time.

Fintech startups can maximize the benefits of P2P networks while lowering risks by combining robust technology with close attention to security and regulatory requirements.

Ultimately, a thoughtfully developed mobile platform becomes the backbone of a successful digital payment experience, helping you stay competitive in an evolving market.

Frequently Asked Questions (FAQs)

2. How Do P2P Payment Networks Work for Fintech Companies in 2026?

P2P payment networks allow fintech companies to enable direct money transfers between users without relying on banks or intermediaries. Transactions are typically processed in real-time via mobile apps or online platforms, often using encryption and tokenization to secure data. These networks also allow startups to offer multi-currency and cross-border payment solutions efficiently.

3. What are the Risks of Using Peer-to-Peer Payment Apps for Businesses?

P2P payment apps are fast and convenient, but businesses should watch out for significant risks:

- Fraud & account takeovers

- Irreversible errors

- Regulatory issues

- Operational glitches

Being aware of these risks helps businesses plan and protect their transactions effectively.

4. What are the Top Mobile Peer-to-Peer Payment Platforms Suitable for Startups?

Startups looking to implement P2P payments need reliable and widely used platforms to ensure smooth transactions. Popular mobile P2P platforms for startups include:

- PayPal

- Venmo

- Cash App

- Zelle

- Revolut

These apps provide real-time transfers, user-friendly interfaces, and multi-currency support for seamless operations.

5. What are the Best Security Practices for Fintech Startups Using P2P Payments?

Following these practices helps startups maintain trust and minimize risks. The security practices include:

- Strong user authentication and access controls

- Encryption and tokenization to protect data

- Regular monitoring for fraud or suspicious activity

- Compliance with KYC/AML regulations

- Easy-to-use dispute resolution tools for users

Safeguard your P2P payment platform for 2026, and handle 1M+ users with zero downtime.

Share your thoughts about this blog!